Backblaze: The Cloud Dark Horse Ready to Disrupt the Industry

Trading at 2.2x 2024 Sales, Backblaze's Affordable Storage Solutions are Fueling the Enterprise Shift to Data Iceberging and AI deployments

This is a golden opportunity to purchase a company that I believe is perfectly positioned to take advantage of changing trends within the Cloud Services and AI industries — trends that have been mentioned, not only by Backblaze but also by major players such as Snowflake and Amazon.

What the heck is Backblaze?

Backblaze was founded in 2007 by Gleb Budman, Brian Wilson, Billy Ng, Casey Jones, Damon Uyeda, Tim Nufire, and Nilay Patel. Backblaze was initially a service that was focused on helping individuals upload and backup their data for cheapest price possible, and thus, was loved by techies everywhere. Eventually down the line with the cloud revolution, Backblaze added a B2B storage tier that allowed enterprises to benefit from the ridiculously low costs that Backblaze offers. Backblaze also offers a business backup service that caters to small and medium businesses needing a place to backup their data, offering extra tools to manage storage across computers and facilities.

All in all, Backblaze's focus on simplicity, affordability, and reliability has helped it build a loyal customer base among individuals, businesses, and developers.

The Fundamental Shift in the Cloud Services Industry

Throughout the cloud services industry, cloud computing providers such as Snowflake, Databricks, AWS, Azure, and GCP have encouraged customers to store data on their respective platforms. With the average large enterprise using multiple different hyperscalers and even more cloud services, especially with the shift to AI, enterprises are having to store their data in multiple places. With this data storage comes the need for large teams of people to maintain the data across these platforms. In an environment where enterprises are seeking to get more efficient, this is a redundant cost that can easily be shaved off.

In addition, a large part of how these platforms make money is through egress fees. Egress fees are charged when users access the data stored within the platform. Cloud computing platforms are well known for charging high egress fees to customers. For example, in AWS, transferring a terabyte of data out costs 3 times as much as storing a terabyte of data. This has historically had the effect of encouraging customers to store their data in each platform separately as opposed to storing it in one source.

The need to cut costs has customers looking for ways to cut their cloud computing costs, and the data storage and egress conundrum has left customers yearning for a single service that offers both cheap storage and cheap egress (or even free egress).

Enter Backblaze.

How does Backblaze solve the problem?

Backblaze, through its B2 Storage offering, lets customers both store and access data at a cheaper cost than competitors. For example, compared to Amazon, Backblaze offers cheaper storage, while also offering free downloads (this is where egress fees are charged) up to 3 times the amount stored. Even after the 3x limit is surpassed, egress fees are $0.01/gb, which is just 11% of the cost of AWS.

In order to better facilitate the switching process, Backblaze has S3 compatible APIs that help customers easily switch their data to Backblaze. Since launching these APIs, Backblaze has seen petabytes of data being moved from AWS to Backblaze B2 because customers can save so much more on storage and egress fees.

Finally, Backblaze offers tons of integrations so that customers can easily move data over to other cloud service providers to make use of their compute power. This simple integration makes it so that customers rarely have to maintain copies of their datasets on other platforms.

Why Now?

Given the trends described above, this is an opportune time to invest in Backblaze. Management has recognized and seized the opportunity provided by the shifting industry trend and is committed to growing and focusing on B2 Storage. This is reflected in B2 Storage making up a larger percentage of overall sales over time. Management has also started to roll out new products and initiatives based on the growth seen in this sector. A good example is the new “Powered By Backblaze” program, which allows users to build partners and customers to build their services on top of B2 storage. In the fourth quarter, the company launched Shard Stash, delivering significantly improved upload speeds for small file uploads (1 MB or less)—up to 30% faster than AWS S3.

Given the potential flood of new customers using Backblaze, they will also benefit from a network effect of sorts as cloud vendors who don’t already have a Backblaze integration will actively seek out Backblaze to continue serving their customers.

In addition, while the company has seen its fair share of dilution since IPO, this shouldn’t be an issue going forward. Given that Backblaze is EBITDA profitable, and according to company commentary, likely FCF profitable by mid-2025, the need to raise extra cash isn’t too great. In addition, the company currently has over $29 million in cash.

It is also worth noting that Backblaze has tremendous pricing power. Not only are they significantly cheaper than competitors, but they also have an enormous amount of room to raise prices before customers even think about switching cloud storage providers. This was shown in force during the 4th quarter as Backblaze increased prices for both its B2 Cloud Storage and its personal backup segments with no change in NRR. In fact, NRR actually increased in Q4 2023.

Finally, a well-known constraint of AI models is that they need low-cost storage, which is currently hard to come by because of excessive egress fees charged by cloud storage/compute providers such as AWS. Thus, the continued investment into AI also presents a massive opportunity for Backblaze as customers continue to find cheap storage extremely attractive.

Valuation

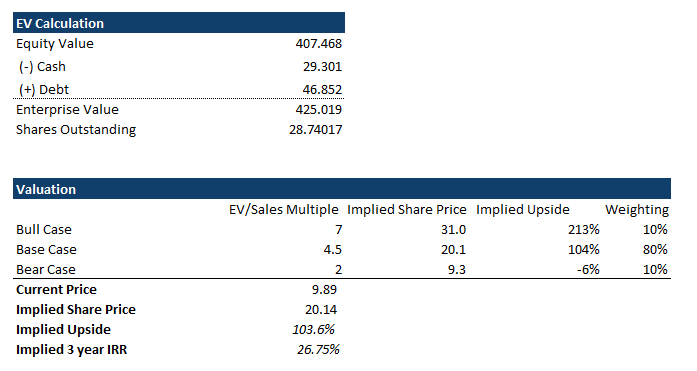

I’ll keep this one short. The jist of things is that Backblaze is currently trading for around 2.2x 2024 EV/Sales for a company that is expected to grow a 70%+ gross margin segment by over 40%, is EBITDA profitable, and expects to be FCF profitable in 2025. That’s absurd.

For context, comps in the cloud infrastructure space such as Snowflake and Amazon trade anywhere from 7-9x 2024 Sales. While Backblaze is in no way representative of the scale of these businesses, it is difficult to argue why it should deserve a 3-4x lower multiple simply for this reason, especially because it is growing faster and exposed to not one, but two different secular tailwinds.

With all of this in mind, Backblaze should trade somewhere closer to 4.5-5x Forward Sales, which is captured in the base case. The base case assumes that current trends continue and that Backblaze continues to consolidate the midmarket while slowly moving upstream. This should enable them to grow revenues in the enterprise storage segment by 30-40% for the next few years at least.

In the bull case, we assign a multiple of 7, which is in line with some comps. This multiple would likely be assigned if multiple things go right for Backblaze. First, Backblaze will have to completely consolidate the midmarket and make significant headway upstream. Secondly, Backblaze will likely need to benefit from a larger-than-expected industry shift toward cheaper cloud storage, likely driven from increasing take rates at major cloud service providers like Amazon. While this is quite unlikely to happen (which is reflected in the 10% weighting in the valuation), it is still within the realm given the company outperforms.

In the bear case, we assign a multiple of 2, which is close to the current stock price. For this scenario to play out, we would need to see a complete reversal of both the AI trend and the cloud industry paradigm shift. This is likely caused by some combination of decreased AI innovation/returns and a decrease in prices by the major cloud service providers. While this is again a possibility, it is extremely unlikely as AI investment shows no signs of stopping. In addition, the hyperscaler platforms are the main profit machines for Amazon, Microsoft, and Google, so it is unlikely that they decrease prices just to compete with a smaller competitor.

Putting all of the cases together, we get a target price of $20.14, which represents a 103.6% upside or a 3-year IRR of 26.75%. While this is a concrete price target, we should continue to evaluate price in the context of future results, adjusting expectations up or down based on how well the business does.

Conclusion

Backblaze is a leading cloud storage benefitting from two broad industry trends: The shift to iceberging driven by the need for cheaper cloud storage costs, and the continued development of AI models by enterprises for both internal and external use. The enterprise cloud storage business represents about half of the total company’s revenues right now and is poised to continue to have low-mid 30s revenue growth for the next few years. We’re getting all of this for about 2.2x 2024 EV/Sales, which represents an attractive opportunity to get in as the multiple re-rates closer to 4.5-5x 2024 EV/Sales.

Good article:)

Good stuff